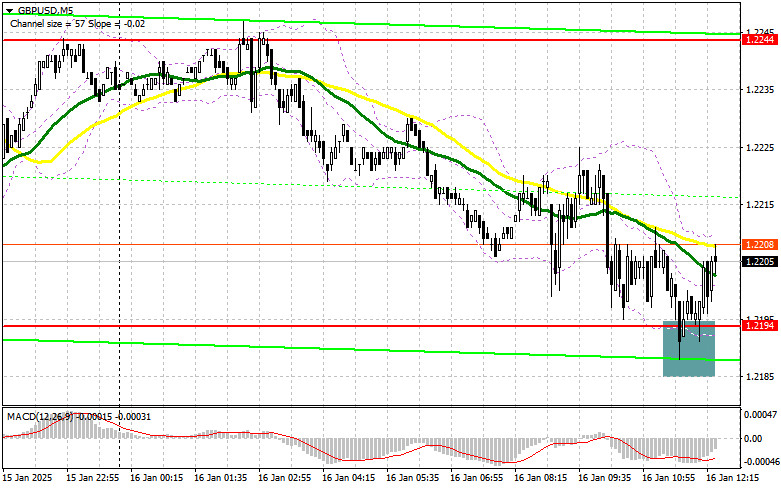

In my morning forecast, I focused on the 1.2194 level and planned to make trading decisions based on its behavior. Let's analyze the 5-minute chart to see what happened. A decline followed by a false breakout at this level provided a good buying opportunity for the pound, which so far has resulted in only a 10-point rise. The technical picture remains unchanged for the second half of the day.

For Opening Long Positions on GBP/USD

News that the UK GDP came in below economists' forecasts triggered selling pressure on the pound, though it didn't lead to a significant drop in the pair. It was evident that the UK economy was going through challenging times, so there were no expectations of extraordinary results for the end of last year. Consequently, the market did not react strongly to the weak data.

The second half of the day should be more eventful, with weekly initial jobless claims and the December retail sales report from the US on the agenda. Weak data could restore confidence in the pound, while strong numbers would renew pressure on GBP/USD.

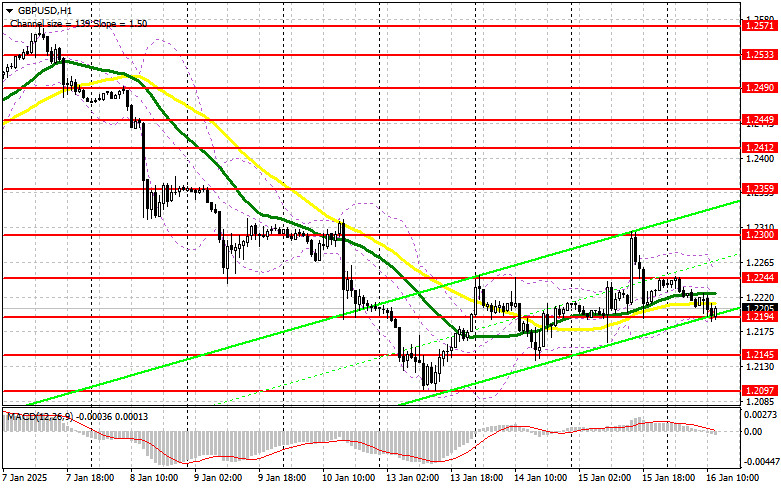

If the pair declines, I will act only after a false breakout around the nearest support at 1.2194, similar to this morning's scenario. The target would be a recovery towards 1.2244 resistance, which was not tested earlier today. A breakout and subsequent retest of this range could create a new entry point for long positions, targeting 1.2300. Buyers are likely to encounter more significant challenges at this level. The ultimate target will be 1.2359, where I plan to take profits.

If GBP/USD falls further and bulls fail to defend 1.2194, the pair may decline more significantly. In this case, I'll wait for a false breakout near the 1.2145 low to consider long positions. Alternatively, I'll open long positions on a rebound from 1.2097, targeting an intraday correction of 30–35 points.

For Opening Short Positions on GBP/USD

Pound sellers tried but failed to take control of 1.2194. However, buyers are not showing much activity either, keeping the potential for further declines intact.

For the second half of the day, it's best to wait for a test of 1.2244, which could occur if US data comes in weak. A false breakout at this level would offer a good selling opportunity, targeting a return to 1.2194 support, where the moving averages—favoring the bulls—are situated, making this area important.

A break and retest below 1.2194 could lead to stop-loss orders being triggered, paving the way for 1.2145 and signaling a stronger bearish market. The ultimate target will be 1.2097, where I'll take profits.

If demand for the pound strengthens later in the day and bears fail to show activity at 1.2244, I'll delay selling until the pair tests the 1.2300 resistance. I'll sell there only after a false breakout. If there's no downward movement from that level, I'll look for short positions on a rebound near 1.2359, aiming for an intraday correction of 30–35 points.

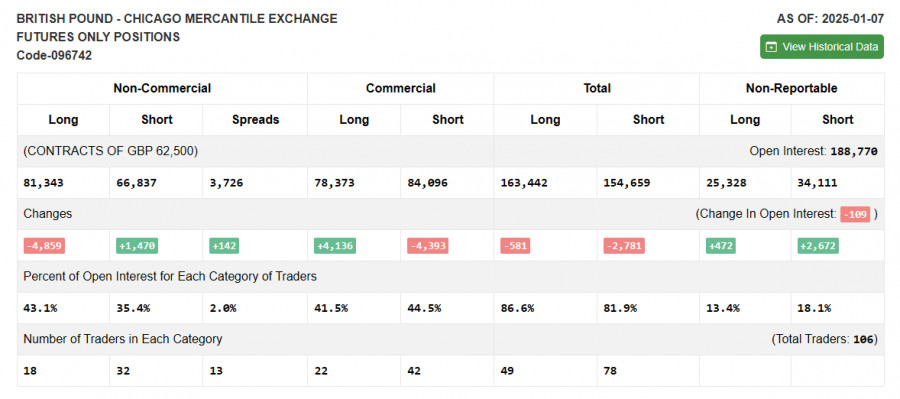

The Commitments of Traders (COT) report for January 7 showed a rise in short positions and a reduction in long ones. Overall, the balance of power has not changed significantly, and the pound, despite the prevalence of bullish positions, continues to lose ground against the US dollar.

Upcoming UK inflation and GDP data may complicate the Bank of England's future decisions, reducing the likelihood of a significant rally in GBP/USD. The report indicated that long non-commercial positions fell by 4,859 to 81,343, while short non-commercial positions increased by 1,470 to 66,837. The net position difference grew by 142.

Indicator Signals

Moving AveragesTrading is occurring around the 30- and 50-day moving averages, indicating market uncertainty.Note: The moving averages are based on the H1 hourly chart and differ from the D1 daily chart.

Bollinger Bands:Support is expected near the lower boundary at 1.2194 in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility and noise to determine the current trend.

- 50-period MA: Yellow line on the chart.

- 30-period MA: Green line on the chart.

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period.

- Slow EMA: 26-period.

- SMA: 9-period.

- Bollinger Bands: Based on a 20-period moving average.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using futures for speculative purposes.

- Long non-commercial positions: Total long open positions.

- Short non-commercial positions: Total short open positions.

- Net non-commercial position: Difference between short and long positions.