The markets reacted strongly to the US inflation report for October. Both indicators, overall inflation, and core inflation, turned out to be below expectations – inflation decreased from 3.7% to 3.2% (forecast 3.3%), while core inflation was down from 4.1% to 4.0% (forecast was for it to remain unchanged).

A dollar selloff immediately started, as the slowdown in core inflation significantly boosts hopes that the Federal Reserve is probably done with the rate hikes, and now financial markets are anticipating an earlier date for the rate cut. A week ago, the first cut was expected in June, before the report, futures on the rate were already targeting May, and after the release of the inflation report, expectations began to shift towards March.

This means that in the near future, the dollar may become even weaker than expected, and therefore, there is a chance for other G10 currencies to recover some losses. Most likely, the initial reaction will determine the sentiment of the market for a longer period – the dollar may be sold off.

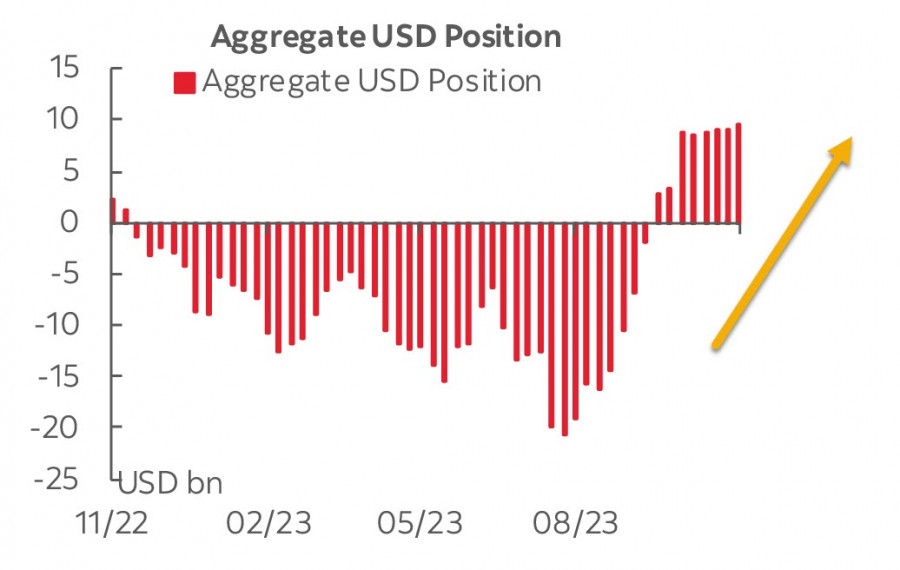

The latest CFTC report did not show significant changes for the major currencies. The Canadian dollar suffered the most (-1.4 billion), and changes in other currencies were significantly smaller. The net long USD position increased by 0.3 billion to 9.4 billion. The dollar is gradually strengthening, but we can consider the rate of growth for the fifth consecutive week as insignificant.

Gold saw insignificant changes (-0.1 billion), for oil, the long position decreased by 1.7 billion, in line with expectations of reduced demand due to global slowdown, but this conclusion is contradicted by a sharp increase in demand for copper (+2.9 billion). The picture is contradictory.

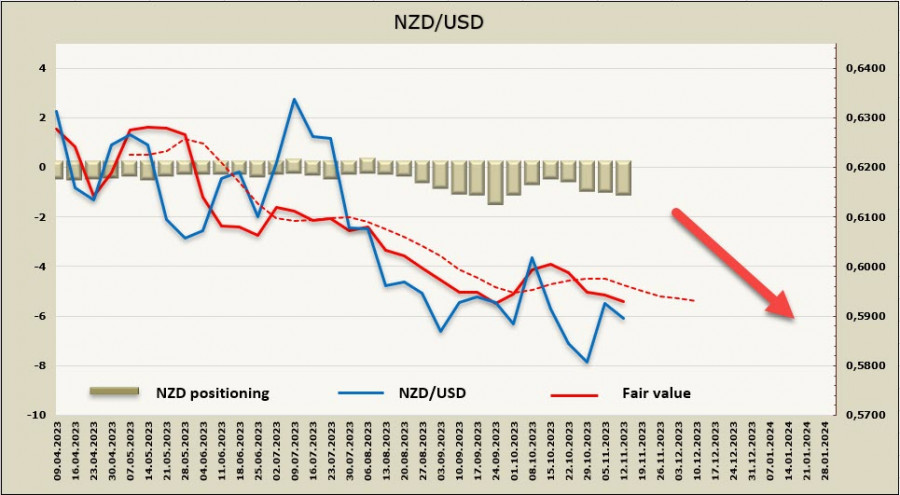

NZD/USD

Last week's research on inflation expectations showed that progress is evident but still clearly insufficient. The mean one-year-ahead annual inflation expectation decreased from. 4.17% to 3.60%, two-year inflation expectations eased slightly to 2.76% from 2.83%, and businesses expect inflation to remain above the target range for another 4 years. Back in August, the Reserve Bank of New Zealand forecasted 2% in two years, so current inflation expectations are much higher than the central bank's own forecasts.

The PMIs look grim. The Manufacturing PMI fell from 45.3 to 42.2 in October, the fifth consecutive month of decline, and excluding the COVID break, activity dropped to the lowest level since the 2008 crisis. All sub-indices, including production, new orders, employment, and deliveries, also declined.

The Services PMI dropped from 50.7 to 48.9, also entering contraction territory. Overall business activity indicates the approach of a recession unless measures are taken to support the economy. However, this cannot be done until inflation slows to acceptable levels, so in the current situation, the RBNZ can only choose between another rate hike, which will accelerate the recession, and a monitoring regime with a refusal to take by active measures.

The net short NZD position increased by 0.1 billion to -0.89 billion, the positioning is bearish, the price is below the long-term average and is pointing downwards.

As expected, the kiwi is trading lower, but there is no strong driver. We consider it unlikely for the New Zealand dollar to rise and expect it to fall to the lower band of the channel at 0.5740/60.

AUD/USD

Business activity indices from NAB show that the gap between the assessment of current and future indicators is growing. Current business conditions remain confidently strong and has even increased (+13p in October compared to +11p in September), while confidence has decreased again and remains significantly below average.

Price pressures also remains elevated, despite a slight decrease in labor and procurement costs, while retail price growth is stable, indicating sustained inflation growth in the fourth quarter. On Wednesday, the wage indicator for Q3 will be published, which will assess labor demand. Growth is expected, which is usually a bullish factor for AUD.

Overall, the assessment that the Australian economy remains resilient by the end of the year has been confirmed. The employment report for October will be published on Thursday, which is expected to be better than the report for September and, in general, it may support the aussie.

The net short AUD position decreased by 0.65 billion to -4.2 billion during the reporting week. The positioning is bearish, but we have observed a decline in the volume of short positions in the last 6 weeks. The price is above the long-term average and is directed upward.

AUD/USD corrected lower after reaching the middle of the channel. We expect another attempt to rise, the nearest target is 0.6470/80, then the local high of 0.6525. Despite the long-term bearish trend, the chances of a more pronounced corrective rise remain high. The AUD/NZD cross is expected to have a bullish direction towards 1.10.