The GBP/USD currency pair began a new wave of upward movement on Tuesday, despite the absence of specific reasons for this trend. There were no significant events occurring in the UK throughout the day, and the JOLTs report was deemed secondary from the outset. However, who is really focusing on macroeconomic data right now when Donald Trump continues to influence the market? In our euro review, we speculated that Trump might have some sort of genius plan, although it's hard to see how, as many of his actions appear completely absurd, negatively impacting both America and its citizens.

Eight years ago, Trump did everything he could to push the dollar's exchange rate down. He believed that the dollar was too strong, making American goods less competitive abroad. As a result, American companies preferred relocating their production to cheaper countries, a trend Trump sought to reverse. His goal was to bring U.S. factories back home, but this effort ultimately failed. He aimed to weaken the dollar to improve the trade balance, but that also did not work. Despite imposing tariffs to create "fairer" trade relations, the results were minimal. In the end, Americans became so frustrated with Trump that after four years, they were willing to vote for just about anyone else.

Now, four years later, Trump seems to be at it again. If his goal is to rapidly devalue the dollar, what would that achieve? Currently, American goods are being boycotted globally. What difference does pricing make if no one is buying them? Furthermore, revenue from oil, gas, and other raw materials won't change either, since global prices are denominated in dollars. No individual country can arbitrarily set its own prices; they can try, but it would be meaningless given that the U.S. isn't a monopoly in oil or gas production. Even if the dollar drops to 1.5 or 1.6 per euro, what would happen next?

One needs to look at the European Union or the UK to see how pointless the dollar's decline is—and how it only undermines confidence in the currency. Their currencies have been falling against the dollar for 16 years. Have their economies seen significant growth during that time? Everything happening in the U.S. now looks like a very dangerous absurdity. Trump is an entirely unpredictable person, and every new speech of his sends shivers through the markets.

The British pound continues to rise without doing anything to justify it. Despite higher time frames still pointing south, both global trends could soon be overturned at this rate. We have repeatedly stated that any rise in the pair is just a correction, and that remains true even now. However, this rally is relentless and incredibly strong, with the market ignoring all fundamental and macroeconomic factors. This means the movement is essentially uncontrollable—and if it's uncontrollable, it's also unpredictable.

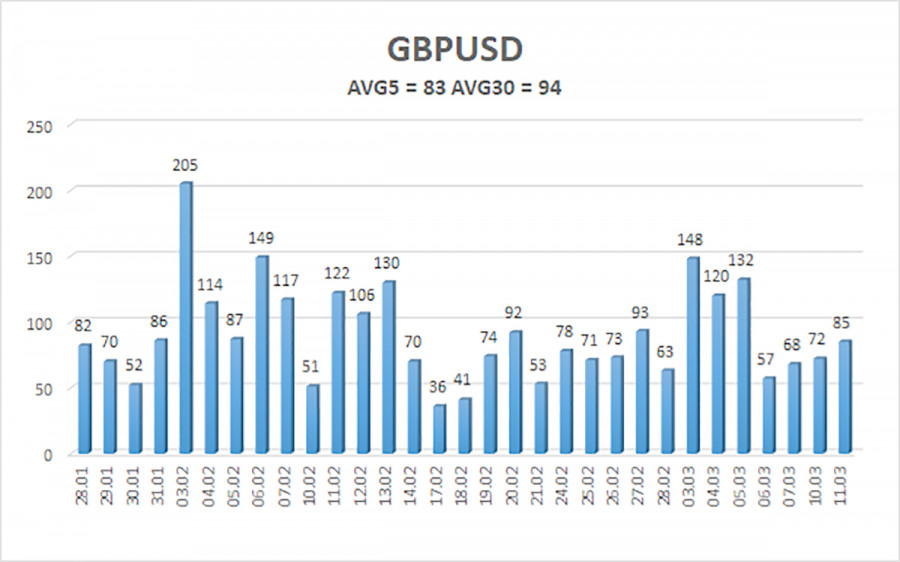

The average volatility of the GBP/USD pair over the last five trading days is 83 pips, which is considered "average" for this pair. On Wednesday, March 12, we expect the pair to move within a range limited by 1.2853 and 1.3019. The long-term regression channel has turned upward, but the downtrend remains intact on the daily timeframe. The CCI indicator has recently stayed out of overbought and oversold territory.

Nearest Support Levels:

S1 – 1.2817

S2 – 1.2695

S3 – 1.2573

Nearest Resistance Levels:

R1 – 1.2939

R2 – 1.3062

R3 – 1.3184

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downtrend. We still do not consider long positions because we believe the current upward movement is merely a correction that has become an illogical, almost panic-driven surge. If you trade purely on technical analysis, longs are possible with targets at 1.3019 and 1.3062 if the price remains above the moving average. However, sell orders remain far more relevant, with targets at 1.2207 and 1.2146, because the upward correction on the daily time frame will end sooner or later. The British pound looks extremely overbought and unjustifiably expensive, but Trump continues to push the dollar into the abyss. How long this dollar collapse will last is incredibly difficult to predict.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.